Regulatory sandboxes are designed and operated in different ways to meet different regulatory objectives. While most regulatory sandboxes are operated by a single entity, in some countries they are operated by more than one regulator, such as the prudential and market/conduct regulator. From a South African perspective, the Intergovernmental Fintech Working Group (IFWG) regulatory sandbox (RSB) is fairly unique as it involves a number of financial sector regulators and is designed to be collaborative. Although we believe that there is benefit in countries operating regulatory sandboxes, it is important to understand how such structures contribute to innovation on the one hand, and the policymaking and regulatory framework setting, on the other. This blog post aims to provide some clarity on the IFWG RSB and how it operates to help create awareness and help innovators consider whether sandbox testing may be an appropriate avenue to explore the regulatory treatment of a specific innovative product or service, ideally before taking innovative products or services to market[1].

What is the IFWG RSB?

In explaining the RSB, it may be useful to start with what the RSB is not designed to achieve. The RSB is not a technical environment created by the regulators where innovators can come and test whether their product functions as expected and whether there may be a market for the product. It is, however, a space to enable testing against regulation, potentially through regulatory relief – where suitable, in an effort to provide regulatory clarity. In other words, the product or service should raise questions around whether it falls within the existing regulatory perimeter or whether a bespoke framework needs to be developed to regulate such innovation. Thus, testing in the RSB should provide clarity to both parties on the appropriate policy and/or regulatory response to the product or service within the financial sector. Given the RSB's specific objective, there needs to be alignment between what the applicant is seeking to do and what regulators are focussed on. The RSB is therefore not looking to have a high turnover, but to allow applications into the RSB which could contribute to informing regulatory approaches/ policy and result in change – where appropriate.

How does the RSB work?

Initially applicants must visit the RSB page on the

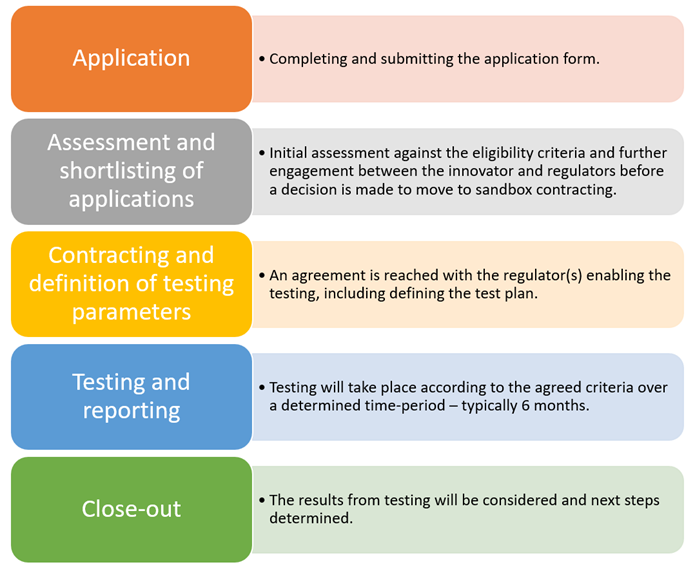

IFWG website and assess their innovation against the sandbox eligibility criteria[2]. The eligibility criteria are only the initial hurdle before an application may be considered by regulatory subject matter experts. Entrance remains at the discretion of the regulators before sandbox testing is explored in detail. The 5 phases of the RSB process are depicted in the below graphic.

The RSB process

What was the IFWG's experience in initially following a cohort-based approach?

The RSB was launched in 2020 on a cohort-based approach. Testing provided insights to both regulators and participants, either on the fit with existing frameworks or by highlighting considerations for future frameworks. A

public feedback report was produced highlighting more detailed insights and has been used to inform the process of creating appropriate and necessary frameworks. The creation of new, or updating of existing, frameworks still follow the relevant processes – which take time, and successful testing does not result in immediate change or immediate regulatory approval. The RSB is meant to support the regulatory or policy-making process and not replace it.

A key take-away for potential applicants

One of the key insights from the initial public feedback report was that applications were received across multiple areas, however the ones that made it through to testing related to areas of focus for the regulators, such as crypto asset regulation. Most applications (78%) exited either during the initial review by the RSB core team or after initial consideration by the regulatory subject matter experts (SMEs), with the most common reason for turning down an application being that there was a misalignment between what an applicant sought to achieve and what regulators were focussed on (resulting in a lack of regulatory appetite). It would benefit potential applicants to understand that the purpose of the RSB is to provide regulatory clarity through practical testing and to ensure that proposed sandbox tests either align with existing focus areas, or that the applicant clearly articulates why a specific area should receive regulatory focus and what regulatory insights will be obtained from the sandbox test.

Learning as we go

In an effort to enhance the functioning of the RSB, the IFWG conducted a retrospective process prior to the completion of the first cohort. Some of the salient insights from the retrospective pointed to the time it took to assess a large number of applications within a group of regulatory SMEs at one time; the process of determining feasible regulatory relief; the importance of clear roles and responsibilities; and the need to be realistic in planning and allowing sufficient time to engage with applications.

After considering various recommendations, the IFWG voted to move to an adjusted rolling-based approach. This means that the RSB will generally remain open for applications and allow the relevant regulators to provide an indication of their focus areas, regulatory appetite, and capacity as well as resource constraints in considering further applications at a particular point in time.

The more agile and continuous process means that the IFWG has been able to give applications due consideration, however more time is needed to determine the success of the shift in approach.

Concluding thoughts

The design of the IFWG RSB enables collective learning between multiple regulators and the policymaker as well innovators. The objective of the RSB is to provide regulatory clarity through practical testing. Despite some of the delays in the RSB, we would deem the sandbox a success as it provided useful insights to both participants and regulators surrounding topics, but it should not be seen as a silver bullet that can solve for all manner of regulatory challenges. The RSB process serves as a useful mechanism for engagement and partnership between the public and private sector on addressing complex issues. The IFWG chose to establish a RSB since it recognised the importance of staying close to innovations in the market and further recognises the importance of a fit-for-purpose design which suits the local context.

The move to the rolling-based approach has been encouraging, for instance, we have had numerous discussions with innovators on whether the RSB was the appropriate channel for them in seeking to obtain regulatory clarity. The

Regulatory Guidance Unit may, for instance, be contacted to obtain an informal steer on the regulatory fit of financial sector innovation – particularly if a potential applicant is not clear on whether its application meets the eligibility criteria of challenging existing regulation. There may also be instances where the practical testing may not be required and clarity may be obtained through discussion with relevant regulatory agencies.

We trust that the IFWG RSB will be able to continue to evolve to serve a market need and thank everybody who served with us in the RSB and all the innovators who have approached it.

Notes

[1] It is important to highlight that the RSB is not an avenue to market a product or as a means to 'soft launch' as solution, however it aims to provide clarity, where required ideally before a product is launched. The RSB has however considered products already launched, particularly where there are no existing frameworks and testing may inform future regulatory treatment.

[2] The eligibility criteria are: the innovation to be tested must be intended for deployment in the South African market; the innovation to be tested must not clearly fit within the existing regulatory framework or it must challenge the existing regulatory framework; the innovation must be beneficial to consumers or the market at large; the innovation must be significantly different from other offerings in the market; the innovation must be ready to be tested; and for cross-border testing an applicant must either prove that it is licensed and in good standing in the other jurisdiction or that it has obtained approval from the applicable regulator in the other jurisdiction to participate in an RSB test in South Africa.