Buy now, pay later: Making Purchases More Manageable (But Proceed with Caution)

By Comfort Phelane | April 2025

Comfort Phelane | Senior Fintech Analyst, South African Reserve Bank | Chair of the IFWG Open Finance Integration Working Group and Lead of the IFWG Innovation Accelerator

The rapid ascent of buy now, pay later (BNPL) services globally is reshaping consumer finance, particularly within the e-commerce landscape, with some estimates that BNPL will account for 12% of total global e-commerce spend on physical goods by 2025[1]. While offering undeniable convenience, BNPL's surge has also triggered significant regulatory scrutiny worldwide. This is especially true within developing economies, where unique challenges and opportunities exist.

What is BNPL and why is it so attractive to consumers?

BNPL is a form of embedded finance[2] solution that lets customers pay for their purchases with interest-free instalments rather than paying the full amount at checkout. They are widely used by consumers for online purchases on e-commerce platforms. BNPL has also been rapidly expanding in physical stores too, facilitated by the use of scannable barcodes and QR codes[3]. The key characteristics of BNPL can be summarised as follows:

Short-term: Typically, short-term credit for a specific purchase and limited amounts.

Instalment Payments: The total purchase price is divided into several payments, often four, spread over a few weeks or months.

No Interest (Often): Many BNPL plans advertise "0% interest," but this usually applies only if payments are made on time. Missed payments can incur significant late fees.

Easy Approval: BNPL providers often have less stringent credit checks than traditional credit cards, making it accessible to a wider range of consumers.

Integration at Checkout: BNPL options are typically integrated directly into the online checkout process making it convenient for consumers to use.

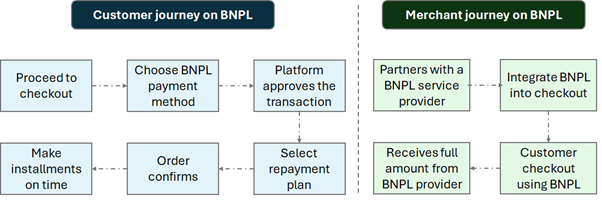

The figure below provides a simplified depiction of a common BNPL business model:

Source: Sanjay Kidecha, 2025, Buy now pay later business model: Why 360 million people used BNPL services worldwide in 2025, Kodytechnolab

BNPL's appeal stems from its simplicity: immediate gratification coupled with instalment-based repayment, often interest-free. The cost of the BNPL service is borne primarily by merchants through a transaction fee charged by the BNPL company for each sale made using their service. This is typically a percentage of the purchase price, as well as potentially charging customers late fees for missed payments or additional fees for credit checks or other services depending on their specific model.

For bearing this cost, the merchant reaps two key benefits: 1) that BNPL solutions help increase sales volumes by making out-of-reach items more affordable for customers; and 2) BNPL options give customers the ability to upgrade their purchases, opting for higher-value items with larger profit margins. Thus, consumers can manage their expenses while incurring only small fees or none. However, imprudent spending or a poor understanding of BNPL terms can lead to over-indebtedness.

BNPL adoption trends globally and domestically

According to some experts, the global BNPL market size was expected to reach about USD 533 billion by 2024, representing compound annual growth rate of 56% from 2021 to 2024[4]. Another study predicted that the number of BNPL users will surpass 670 million globally by 2028 - increasing from 380 million in 2024[5]. The study also found that despite fintech companies commanding the BNPL market for years, there was a major shift since 2023, as bigtech superapps and banks gained traction. This preference for offerings from larger institutions is supported by a U.S consumer study which showed that if available, 70% of BNPL users would rather use instalment plans offered by their banks[6].

Moving closer to home, the adoption of BNPL services is on the rise in South Africa, especially among younger consumers. BNPL payments in South Africa are expected to have grown by 13.6% on an annual basis to reach about ZAR 15 billion in 2025[7]. The CEO of a provider claiming to own 60% of the BNPL market reported they had seen 100% year-on-year growth in 2024 as BNPL becomes more mainstream, expanding from its roots from e-commerce platforms to brick-and-mortar retail stores[8].

The industry is poised for growth going forward with more service providers entering the market. This includes an increasing number of incumbents seizing this opportunity. For example, a digital challenger bank now allows online shoppers to pay 50% of their purchase upfront and then pay off the remaining 50% in two equal payments of 25% each, 30 days and 60 days later.[9] Additionally, one of the big four banks invested ZAR 208 million in a BNPL fintech in 2024[10].

So, what's the problem?

Although BNPL offers several advantages, it is not without risks. Many BNPL providers conduct only limited credit checks, potentially increasing their exposure to defaults. While traditional lenders carefully evaluate credit risk, BNPL providers often skip these steps to maintain a streamlined user experience[11]. Consequently, the risk of default rises as BNPL expands, especially in periods of economic downturn.

There is also the risk of overspending, further adding to over-indebtedness levels in an already strained consumer base[12]. One of the largest BNPL providers in South Africa reported that average order values typically increased by up to 30% with a BNPL checkout, exemplifying the consumer mindset towards buying more items, or more expensive items that they may not typically buy if they had to use a payment solution that charged interest[13]. The risk of increased over-indebtedness is crystalised by research conducted by the U.S Consumer Financial Protection Bureau which found that between 2021 and 2022 borrowers with subprime or deep subprime credit scores made up the majority of BNPL originations at 45% and 16% respectively[14].

Other challenges presented by BNPL include:

Hidden fees: While "0% interest" is a common marketing claim, late fees, missed payment fees, and other charges can quickly add up;

Lack of Transparency: Consumers may not fully understand the terms and conditions of BNPL agreements, leading to unexpected charges; and

Credit Reporting: The impact of BNPL usage on credit scores is still evolving. Some providers report to credit bureaus, while others don't, which can make it difficult for lenders to assess a consumer's overall creditworthiness.

The regulatory response:

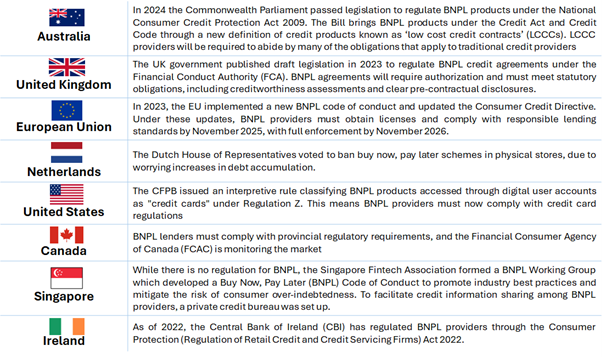

Most BNPL credit agreements have fallen largely outside the scope of existing regulations, but recent government amendments aim to bring BNPL into scope, ensuring consumers are protected from irresponsible lending practices that could lead to over-indebtedness. The table below provides a summary of developments in some jurisdictions:

Source: Norton Rose Fulbright, 2023, Buy now pay later: Regulation Around the World

Considering the path for South Africa going forward

Currently, BNPL models in South Africa fall outside the ambit of existing regulatory and legal frameworks such as the National Credit Act No. 34 of 2005. However, with the rapid growth of BNPL services, there is an expectation that the regulatory frameworks will evolve to address the emerging BNPL risks and concerns. These include the following which require further consideration:

Consumer Protection: Providers need to be transparent about fees and terms, and consumers need to be protected from unfair or deceptive practices.

Consumer Education: BNPL providers should prioritize educating consumers about responsible borrowing and the potential financial risks involved. In addition to clear communication terms, fees, and charges, BNPL providers should also offer resources to empower consumers to make informed financial decisions.

Credit Reporting: There is a growing push for BNPL providers to report consumer payment history to credit bureaus, which would help lenders assess creditworthiness more accurately.

Affordability Assessments: BNPL providers need to conduct more thorough affordability assessments to ensure that consumers can repay their BNPL debts.

Regulation and oversight: A clearer regulatory and oversight framework would minimise bad actors in the market as well as enable regulators to monitor the participants in the sector and its growth.

[1] Stitch Money, 2024, The rise of Buy Now, Pay Later (BNPL) in South Africa; https://www.stitch.money/blog/exploring-the-rise-of-buy-now-pay-later-bnpl-in-south-africa

[2] Embedded finance refers to the incorporation of financial services or products into non-financial platforms (e.g. e-commerce, travel, entertainment, etc.)

[3] Giulio Cornelli, Leonardo Gambacorta and Livia Pancotto, 2023, Buy now, pay later: a cross-country analysis, BIS Quarterly Review; https://www.bis.org/publ/qtrpdf/r_qt2312e.htm

[4] Lafferty Group, 2024, Buy now pay later index 2021 - 2024

[5] Juniper Research, 2024, Global Buy Now, Pay Later Market 2024-2028

[6] PYMNTS, 2022, Banking on Buy Now, Pay Later: Installment Payments and FIs' Untapped Opportunity

[7] ResearchAndMarkets.com, 2024, South Africa Buy Now Pay Later Business and Investment Opportunities Databook

[8] Nkosinathi Ndlovu, 2024, BNPL is taking off in South Africa, TechCentral

[9] https://www.tymebank.co.za/accounts/moretyme/

[10] https://corporateandinvestment.standardbank.com/cib/global/deals/standard-bank-provides-zar200m-growth-facility-to-float-technologies

[11] Gerhard Janse van Vuuren, 2024, How Buy Now Pay Later is transforming South Africa's retail landscape

[12] September 2024 numbers from the National Credit Regulator showed that out of the 28.3 million credit-active consumers in the country, 10.19 million (about 36%) were considered impaired. This means that they had been in arrears for three or more months, had adverse listings, or had judgments and administration orders against them.

[13] Nkosinathi Ndlovu, 2024, BNPL is taking off in South Africa, TechCentral

[14] CFPB, 2025, consumer use of buy now, pay later and other unsecured debt

Disclaimer: As the IFWG we are enthusiastic to include diverse voices through our media content. The opinions of participants do not necessarily represent the views of the IFWG and their respective organisations.

Disclaimer: As the IFWG we are enthusiastic to include diverse voices through our media content. The opinions of participants do not necessarily represent the views of the IFWG and their respective organisations.