Open Finance: A potential solution for financial deepening in South Africa?

Comfort Phelane

Senior Fintech Analyst in the South African Reserve Bank's Fintech Unit focused on

open finance and financial inclusion, and co-leading the IFWG's Innovation Accelerator

This blog post is the first in a series of posts that will delve into open finance, starting with an introduction to open finance, and then diving deeper into specific components of open finance in the blog series.

Technology and the increasingly demanding customer

Digital services are fundamentally redefining customer expectations in terms of service levels and personalisation. As technology enables an enhanced customer experience, customers will increasingly expect more from their service providers, including in the financial sector. In turn, incumbent financial firms are continuously looking for ways to enhance customer experience and maintain a competitive advantage. Globally and locally in South Africa, a growing number of users, particularly younger and tech-savvy consumers, are seeking financial services providers that help them achieve their unique outcomes, that have their best interests at heart and offer truly personalised services - in a safe and secure manner. To meet these demands, data and technology are driving changes in financial services markets, producing new business models, products, and ways for firms to engage with their customers.

Until the last six years, banks and other incumbents had maintained exclusive access to customer data. And while this data was shared with other service providers in specific and limited arrangements - which protected the relationship of incumbents with their customers - a system where external parties were able to access this customer data and use it to independently design and offer their own products and services to customers was largely unheard of.

Cue in open finance, a new paradigm seeking to break these barriers in the financial services ecosystems.

What is open finance exactly?

Definition of open finance

Open finance is defined as a framework that allows the sharing and leveraging of customer-permissioned financial data by financial services providers with third-party providers who can then use that data to develop innovative products and services with customer consent. It is an extension of open banking, which primarily focuses on the sharing of customers' banking current account/ transaction data and includes other financial services such as consumer and business credit, insurance, investments, pensions, and mortgages. It also extends beyond banks to the wide spectrum of financial service providers that store customer financial data such as insurers, lenders, wealth management firms, and others.

Starting off as a regulation in Europe and the U.K, open banking regulations required banks to open-up customer data to third-party providers via application programming interfaces (APIs)[1] This created an open ecosystem that allows licensed third-party providers, and even banks, to use customer financial data to create truly customized products, services, and experiences.

Since then, open banking has expanded to other regions of the world and has been transforming financial services industries. In the economies where open banking regimes have been adopted, particularly advanced economies, open banking has started to break up the data silos of incumbents to give way for fintechs and other innovators to access customer data – including transaction data – and use that data to develop new products and services that are more aligned with customer needs.

Why is this important for South Africa?

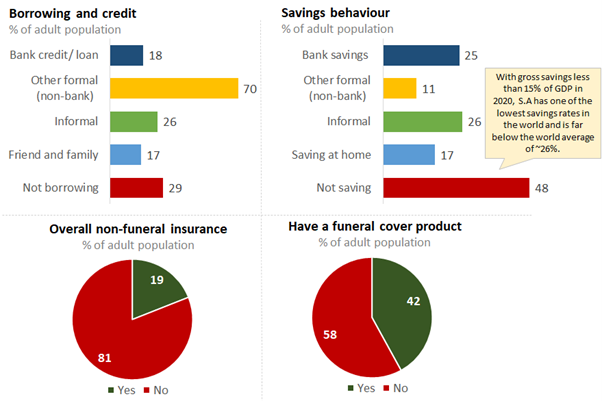

In emerging economies, open banking is still at infancy stage, and presents an opportunity to fast-track innovation in financial services to promote greater access and usage in financial services, increase competition in financial services, and improve the financial wellbeing of citizens. In South Africa, for example, open finance has the potential to positively contribute towards financial inclusion and deepening. This is particularly important for South Africa, because although the breadth of financial inclusion in South Africa is high (nearly all adults have a bank account), the depth of financial access and usage can be improved with a significant portion of the adult population that does not save (48%), borrow (29%), or have insurance (46%) as reported in the 2021 FinScope Consumer Survey conducted by FinMark Trust.

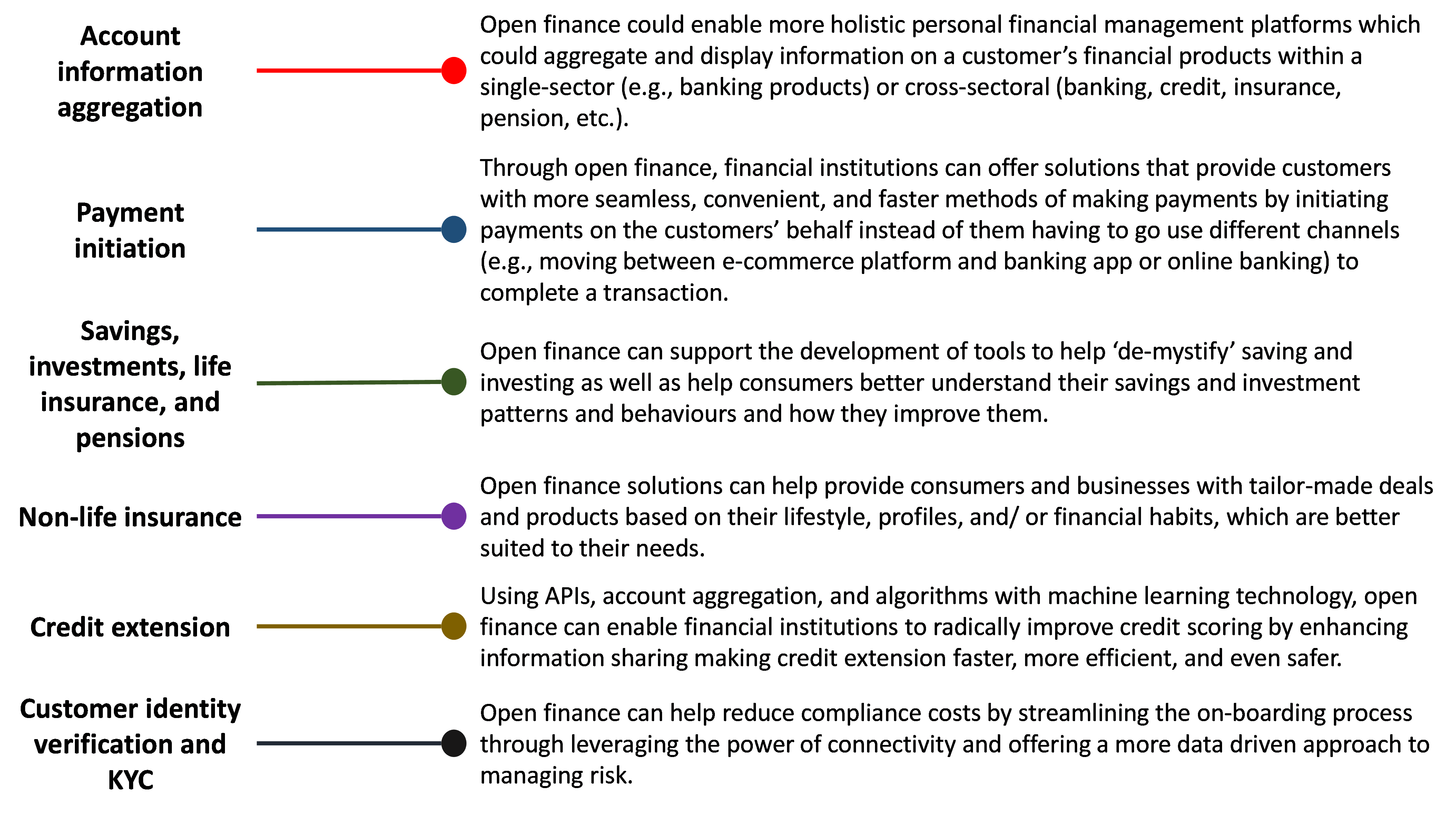

By enabling third-party providers to access customer financial data, open finance provides several use cases that could support financial inclusion and deepening including:

Some of these innovations have already been launched in South Africa by a few start-ups, but mainly make use of screen scraping[2], which is considered a riskier method of sharing data with third-party providers and has been cautioned against by the SARB and FSCA.

With great power (or potential) comes great responsibility

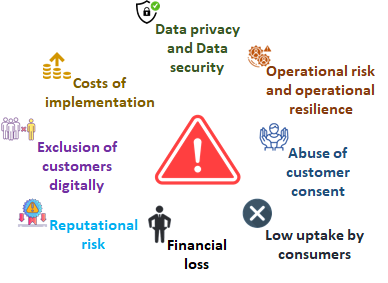

Although open finance presents several opportunities to advance the digital development of the financial sector and benefit the financial wellbeing of consumers, it is important to reflect on the potential risks that open finance may pose and the complexities that it introduces in order to ensure that it is embraced in a manner that is not only inclusive but is also safe for consumers and the broader financial system. The key risks identified for South Africa can be summarised as:

Given these opportunities and threats, it is imperative to establish a clear policy stance on open finance and embark on a path of creating a regulatory framework for it which addresses the risks highlighted above. One important consideration for example will be how to appropriately amend a regulatory framework that historically evolved around the very existence of a central intermediary being held accountable – to cater for this decentralised value proposition brought on by open finance.

In light of these developments, the South African regulatory authorities have started looking at open finance as it relates to their respective mandates. The IFWG has also established the Open Finance Integration Working Group (OPI WG) as a collective of different regulators who collaborate on work to build a better understanding of open finance and gather insights to inform how to shape the potential regulatory framework for open finance.

In the next blog post in this series, we will look at how open finance has been approached in other countries, and start discussing how South Africa, with its unique circumstances, might think of a regulatory and supervisory approach to open finance.

Notes

[1] APIs are software tools that enable different systems and apps to talk to one another and share data

[2]Screen scraping refers to when third-party companies access consumer bank accounts by offering consumers a portal that mirrors the online banking portal and feels like a typical login page. The customer enters their banking credentials, which are then captured and stored by the third-party company. This allows the third-party to log into the customer's account, and the bank is not able to detect the difference. Third-party firms practising screen scraping to initiate payments offer confirmation of payment in real time when purchasing goods and services online, which makes it more attractive to merchants and consumers.

...............................................................................................................................................................................................................................................................................................

SHARE THIS BLOG

Disclaimer: As the IFWG we are enthusiastic to include diverse voices through our media content. The opinions of participants do not necessarily represent the views of the IFWG and their respective organisations.

Disclaimer: As the IFWG we are enthusiastic to include diverse voices through our media content. The opinions of participants do not necessarily represent the views of the IFWG and their respective organisations.