Senior Specialist: Fintech and Co-Lead of Regulatory Guidance Unit | FSCA

Introduction

In the dynamic world of financial services, the integration of Artificial Intelligence (AI)[1] with Quantum Machine Learning[2] is poised to usher in a revolutionary era in computational capabilities. This powerful combination is set to revolutionize the industry by offering unprecedented computational power and intelligent data analysis capabilities. Quantum Machine Learning and AI are both remarkable technologies on their own, but when combined, they can create even more amazing possibilities for the future of financial services. The financial sector deals with large amounts of data, complex problems, and high-stake decisions, and it can benefit from the speed, accuracy, and intelligence that Quantum Machine Learning and AI can provide.

The benefits and risks of the synergy between Quantum Machine Learning and AI in the financial sector

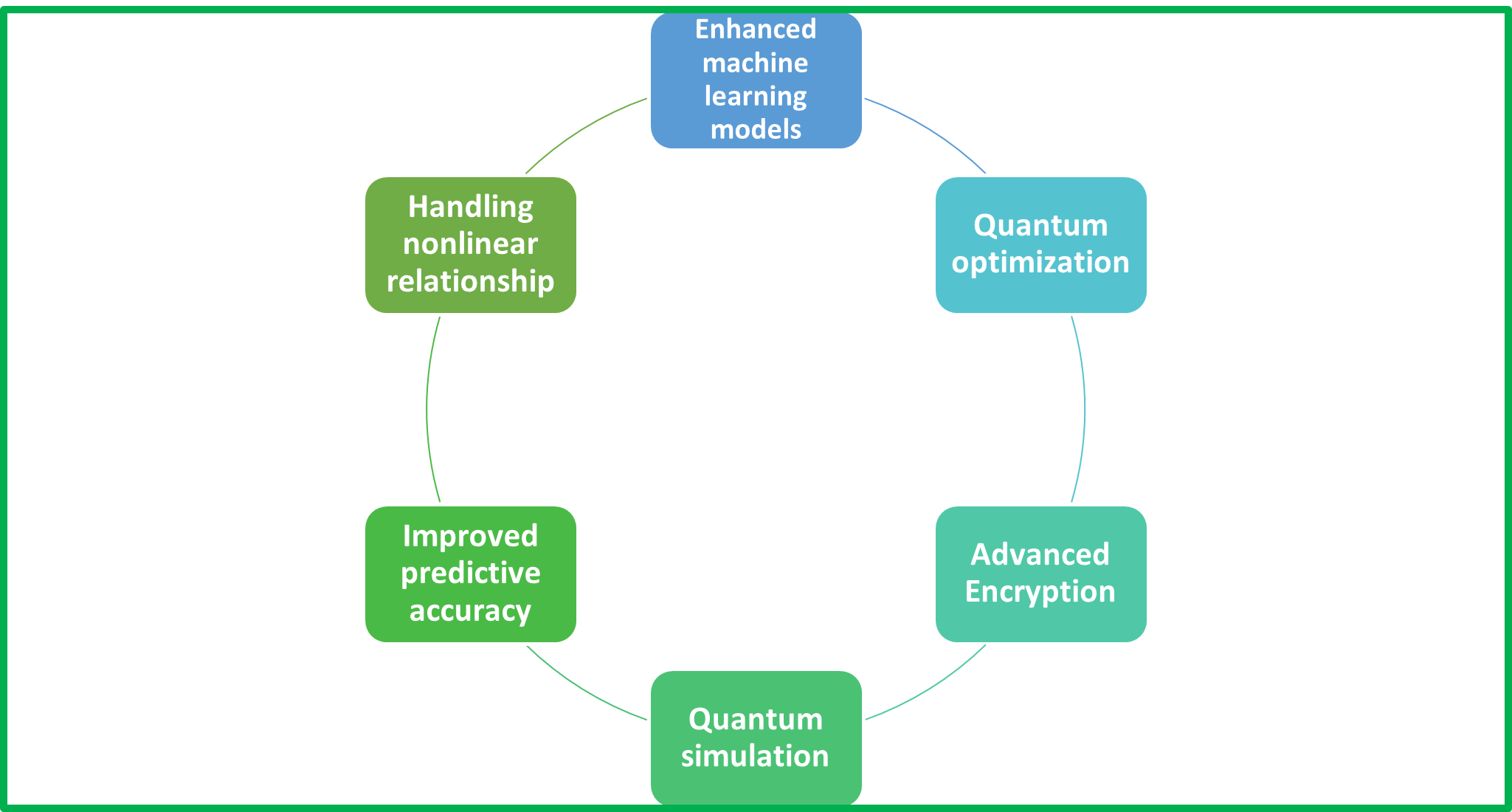

From a financial sector perspective, Quantum Machine Learning will also be more transformative[3]. Embracing the potential of AI integrated with Quantum Machine Learning, while addressing their challenges head-on, will be key to harnessing their power for the betterment of humanity across the globe. The combination of Quantum Machine Learning and AI can significantly benefit the financial sector in several ways as displayed in Figure 1.

Figure 1: Benefits of the synergy between AI and Quantum machine learning

.

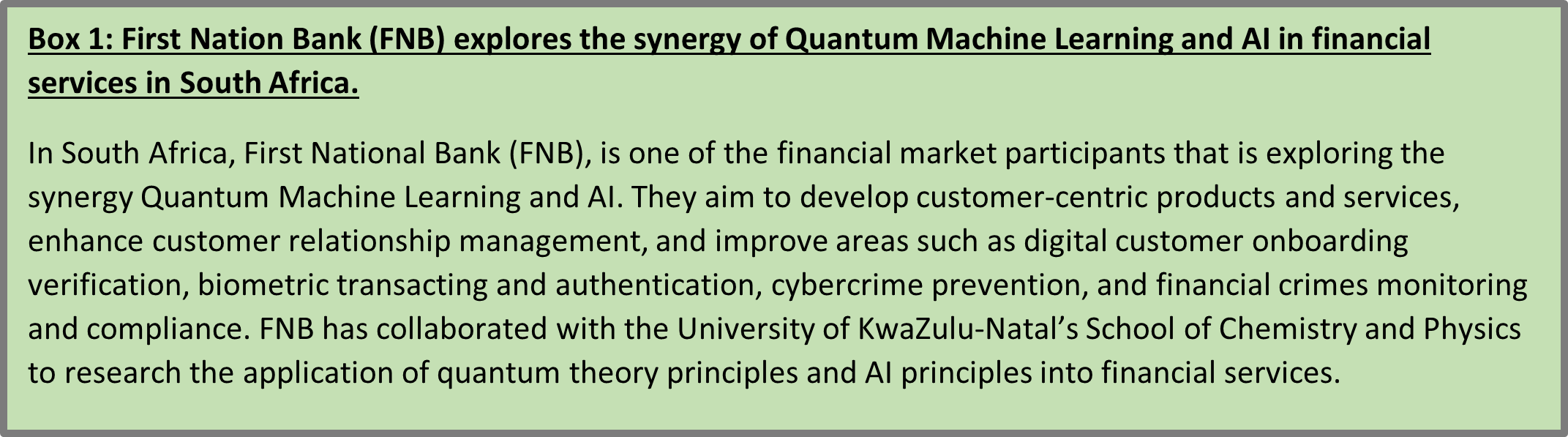

As you can see, the synergy between Quantum Machine Learning and AI can work together to solve complex and high-value problems in finance and provide a competitive edge and better customer experience in this industry in South Africa, see Box 1[4].

While promising significant advancements, this new era also brings with it a set of potential risks that warrant careful consideration. One of the most pressing concerns is cyber security. Quantum computers, with their exceptional ability to process information and break traditional encryption methods, could render current cyber security protocols obsolete, exposing sensitive data to new vulnerabilities. This poses a significant risk to national security, financial systems, and personal privacy, which further include:

Cybersecurity Threats: Quantum Machine Learning could potentially break traditional encryption methods, leading to increased vulnerability to cyber-attacks[5]. Hackers may use AI for more effective tactics, such as spear phishing and mimicking customer voices for fraudulent transactions[6].

Market Stability: The rapid processing capabilities of Quantum Machine Learning could lead to significant market volatility if not managed properly. Sudden shifts in market dynamics due to quantum-powered decisions could destabilize financial markets[7].

Regulatory and Compliance Challenges: The financial sector may face difficulties in meeting regulatory and compliance requirements due to the advanced capabilities of Quantum Machine Learning and AI. This includes managing cryptographic data breaches and privacy concerns[8].

Technological Debt: Financial institutions may incur technological debt if they fail to keep up with the pace of quantum technology development and its integration into their systems[9].

Ethical and Environmental Considerations: The deployment of Quantum Machine Learning and AI must consider ethical implications, such as bias in decision-making, and environmental impacts due to the energy consumption of quantum computers[10].

Skills Gap: There is a risk of a skills gap, as the financial sector may struggle to find enough professionals who are literate in quantum technologies to effectively manage and utilize these systems[11].

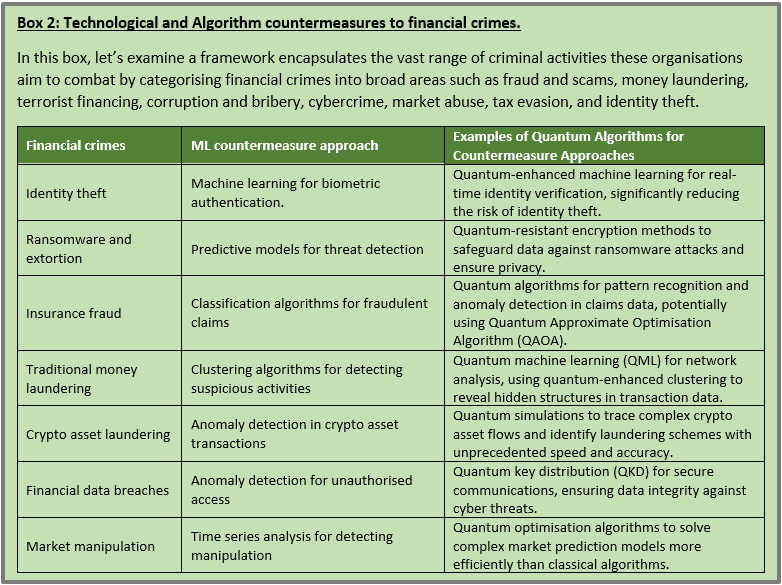

These risks highlight the need for a careful, strategic, and risk-based regulatory approach to managing the potential synergy of Quantum Machine Learning and AI in the financial sector to mitigate potential negative impacts, see Box 2[12].

Considerations for a responsible AI and quantum machine learning future

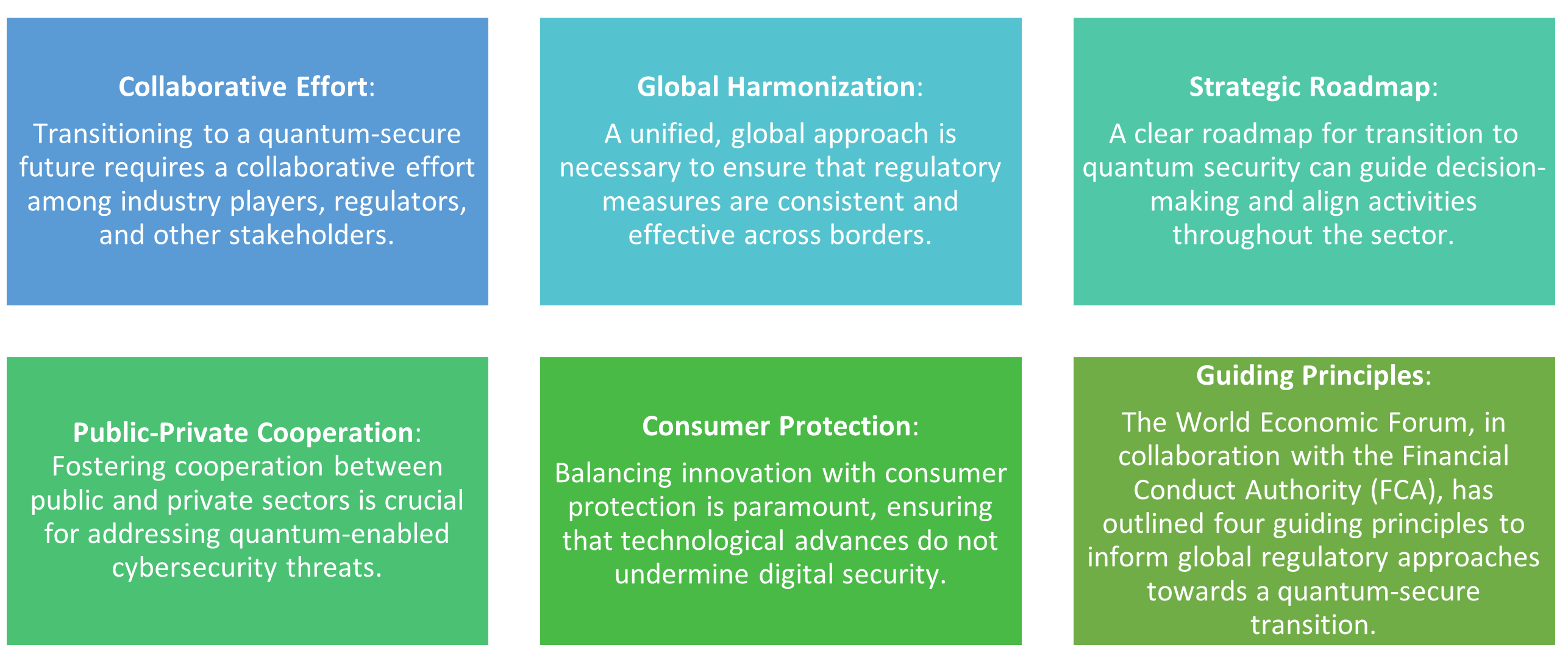

Regulatory approaches to managing the risks of Quantum Machine Learning and AI in the financial sector are evolving to address the unique challenges posed by these technologies. Key principles and strategies are illustrated in Figure 2. These approaches aim to mitigate potential disruptions and ensure that the financial sector can safely harness the benefits of the synergy between Quantum Machine Learning and AI, where the OECD AI Principles[13]are adopted in the AI systems that are combined with Quantum Machine Learning principles.

In conclusion, the synergy between Quantum Machine Learning and AI represents a powerful tool for transforming the financial sector, but its adoption must be guided by responsible and balanced regulation to ensure the integrity, security, and ethical use in the financial sector.

Figure 2: Regulatory considerations to adopting QML integrated with AI

[1] Artificial intelligence (AI) technology uses algorithms and data to create machines and systems that can perform tasks that normally require human intelligence, such as reasoning, learning, decision-making, and natural language processing.

[2] Quantum machine learning (QML) is an emerging field encompassing systems learning without being programmed or modified.

[3] Investec (2023), “Quantum computers: is your company ready for Q-day?", available

here.

[4] ITWEB (2020), “FNB takes a quantum leap in computing", available

here.

[5] Quantum Security for the Financial Sector: Informing Global Regulatory Approaches

https://www.weforum.org/publications/quantum-security-for-the-financial-sector-informing-global-regulatory-approaches/#:~:text=Quantum%20Security%20for%20the%20Financial%20Sector%3A%20Informing%20Global%20Regulatory%20Approaches,-Download%20PDF&text=This%20white%20paper%2C%20developed%20by,harmonized%20approach%20to%20quantum%20security.

[6] Minimising The Risks: Quantum Technology and Financial Services.

https://www.ukfinance.org.uk/system/files/2023-11/Minimising%20the%20risks%20-%20quantum%20technology%20and%20financial%20services.pdf

[7] AI and quantum technologies are transforming financial services | World Economic Forum

https://www.weforum.org/agenda/2024/01/ai-quantum-technologies-transforming-financial-industry/

[10] See Footnote 10

[10] See Footnote 10

[10] Quantum AI in Finance: Transforming Risk Analysis in 2024.

https://www.analyticsinsight.net/quantum-ai-in-finance-transforming-risk-analysis-in-2024/

[11] New IFZ Paper Explores the Opportunities and Challenges of Computing and AI in Finance.

https://fintechnews.ch/aifintech/new-ifz-paper-explores-the-opportunities-and-challenges-of-quantum-computing-and-ai-in-finance/68713/

[12] ARVIX (2023), “Quantum Algorithms: A New Frontier in Financial Crime Prevention", available

here.

[13] OECD AI Principles Overview |

https://oecd.ai/en/ai-principles