The Nexus Between Generative AI and Open Finance: The Next Frontier in Financial Innovation

By Nolwazi Hlophe and Keith Sabilika | October 2023

NOLWAZI HLOPHE

Senior Specialist: Fintech, FSCA and Co-leading the IFWG’s Regulatory Guidance Unit. |

|

KEITH SABILIKA

Senior Specialist: Fintech, FSCA and Co-leading the IFWG’s Regulatory Sandbox. |

Generative Artificial Intelligence (GenAI) application in open finance presents unique opportunities. In the realm of financial technology, the combination of open finance and GenAI has emerged as a dynamic force, reshaping the financial landscape in unprecedented ways. These two technological innovations have the potential to not only disrupt the financial sector but have also found growing relevance in the South African financial landscape. Open finance, a concept built upon the principles of open banking is characterised by granting licensed financial institutions and third-party providers (TPPs) user financial information, contingent on the user's consent. GenAI is a subset of AI centered on creating new and original content. When combined, these two innovative concepts hold the potential to transform how we perceive and interact with financial systems.

So, what is open finance? The concept of open finance is built on the principle of customers owning the data that they create on the platforms of financial institutions and having the right to share that data with suitable and authorised third parties. Through open finance, financial system participants and general society will be provided with more diverse and tailored financial services, through the competitive environment enabled by open finance. However, the design of an impactful and scalable open finance ecosystem is significantly influenced by the architecture of the open identification and authentication Application Programme Interfaces (APIs) that underlie it. One of the defining characteristics of this architecture is how it handles connections between participants of the open finance ecosystem[1].

The objective of open finance is to enable the seamless sharing of financial data and services between incumbent financial institutions, TPPs and consumers, ultimately supporting financial inclusion, greater competition, innovation, and improved financial accessibility and experiences. It also grants consumers greater control over their financial data and transactions. Key open finance uses cases include:

Account aggregation: The aggregation of financial data of a single customer into a single location for that customer. The financial data can relate to financial transactions, credit, investment, mortgage, and savings accounts (including retirement fund accounts).

Financial Management: The automation of financial management by enabling applications to make financial-related decisions based on customer preferences and information.

Payment Initiation: The initiation of payments by authorised TPPs on behalf of the account holder with their explicit consent. This enables users to initiate payments directly from their accounts without relying solely on their bank's infrastructure.

Alternative Lending: The creation of personalised credit scores through the enrichment of financial data retrieved from one or more connected financial institutions, which is usable by lenders, brokers, and banks.

Insurance: The accessing and sharing consumers' insurance services data (e.g., their insurance policies data, such as an insured object, coverage, claims history, and Internet of Things data etc.) between insurers, intermediaries or TPPs to build applications and services.

What is GenAI then? GenAI refers to a branch of AI techniques and models designed on large and diverse datasets, harnessing the power of Machine Learning (ML) to generate new content that is creative, original, and often mimic content created by humans. The advent of GenAI has accelerated AI adoption in the financial sector and its capability to process very large and diverse data sets and to generate content in accessible and easily usable formats is proving quite useful in improving customer satisfaction and experience, risk mitigation, and compliance reporting for financial institutions[2].

GenAI has also presented opportunities to the open finance ecosystem through the following use cases.

Firstly, conversational finance powered through chatbots similar to the popular ChatGPT, enable improved financial management through the benefits of personalised financial advice, improved customer support and payment notifications.

Secondly, GenAI supports the facilitation of the loan decision-making process through a conditional generative adversarial network model (GAN), which is a type of generative model based on deep neural networks. When these models are trained on historical data, GenAI can detect and identify potential financial risks and therefore provide early warning signs such that financial services providers (FSPs) have the time to prevent, or mitigate, against any potential losses. This can be applied in evaluating borrowers applying for credit, instead of relying on existing or traditional credit scoring methodologies to determine credit worthiness. FSPs can input vast amounts of data from multiple sources to input into GAN models and create a more financial picture of loan applicants during the loan application process thereby generating more understandable explanations for loan applicants using alternative credit scoring.

Lastly, the GenAI application modernisation and document analysis use cases present the opportunities of enabling the payment initiation and account aggregation use cases in open finance respectively. GenAI can convert code from old software languages to modern ones. Furthermore, GenAI can be used to process, summarise, and extract valuable information from large volumes of financial data.

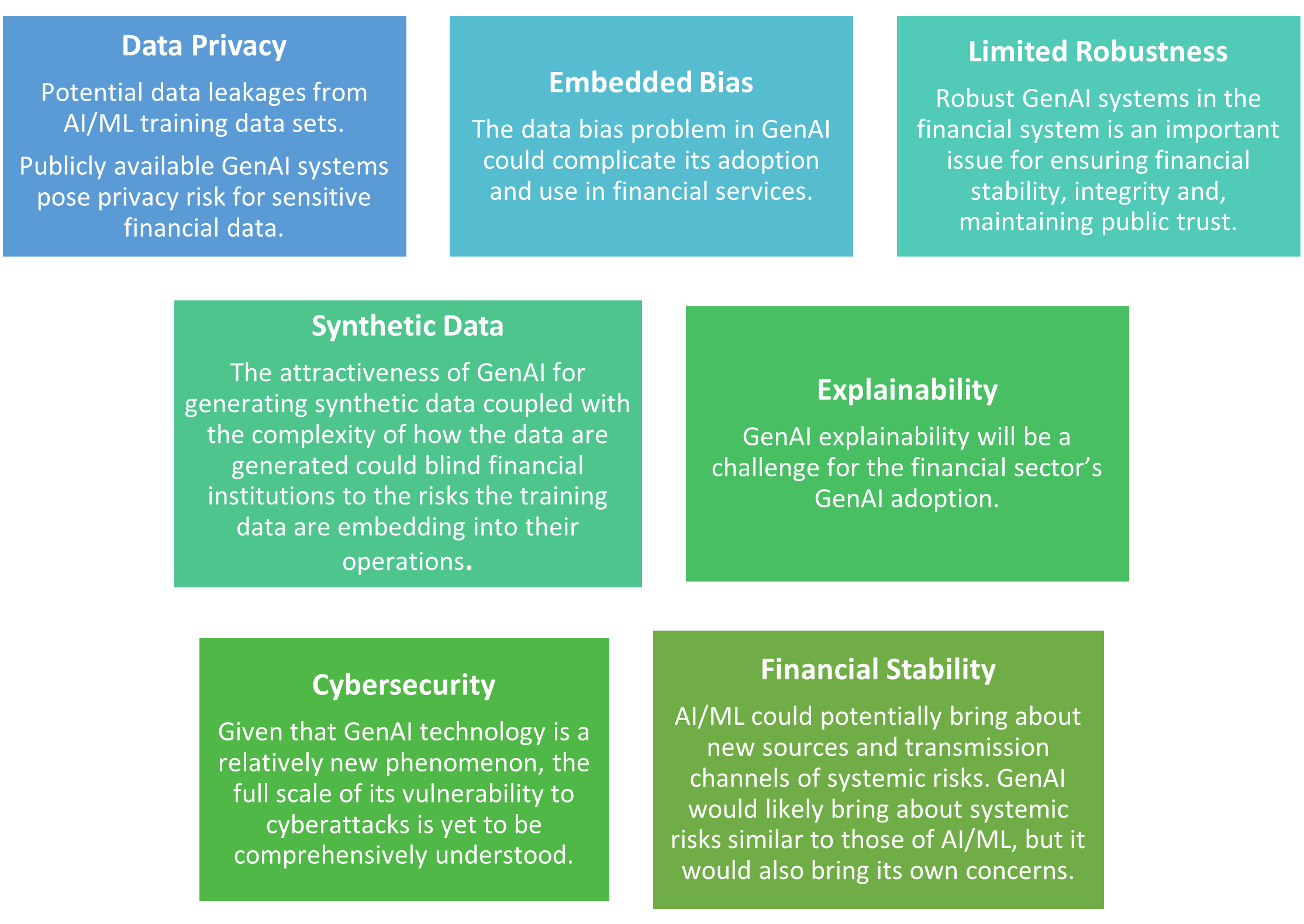

However, the key question is, what are the inherent risks and challenges from GenAI that can spillover into the open finance ecosystem? Let's discuss them here. The deployment of these two ground-breaking innovations raises several concerns including data privacy, cybersecurity, embedded bias, limited robustness, synthetic data and explainability. Figure 1 further discusses these risks.

Figure 1: GenAI Risk Considerations for Open Finance

Source: IMF (2023)

GenAI models often lack transparency due to their unpredictability therefore innovators behind them may not always understand how they work. The models also carry the unintentional risk of collecting and utilising personal information, which might otherwise require explicit consent.

Under an open finance regime, financial data is shared in a consent-based mechanism. However, in the digital era of GenAI, one may question what consent looks like today in South Africa. The Protection of Personal Information Act, 2012 defines consent as, “any voluntary, specific and informed expression of will in terms of which permission is given for the processing of personal information", where the definition of personal information if fully described in the same Act in s (11)(1). The FSCA's Draft Position Paper on Open Finance posits a financial data sharing proposal where financial data to be shared is primary and secondary data prior to enrichment, or further processing. The compliance with the Protection of Personal Information Act would significantly firm up the existing Open Finance market practices within South Africa and help contain some of the conduct risks stemming from these innovations.

What design considerations would potentially need to be set in place by financial sector authorities and the private sector to create an environment where GenAI tools enable the growth of the open finance ecosystem? The design considerations should serve as a nexus of the AI design principles and the open finance considerations, which enable an environment that ensures the growth of the open finance ecosystem in a safe an ethical manner for customers. Furthermore, the stakeholders abovementioned would need to collaborate in their approach towards this approach towards these considerations. Let's discuss the following considerations.

Application of the AI design principles within the use of GenAI in open finance: To ensure the first step towards treating customers fairly, the following AI design principles need to be applied within the technological integrations of open finance applications using GenAI:

Socially beneficial

Avoiding creating or reinforcing unfair bias

Be built and tested for safety

Be accountable to people/customers

Incorporate privacy by design principles[3]

Uphold high standards of scientific excellence[5]

Regulatory Compliance: Continuous monitoring of the financial regulation and industry guidelines regarding open finance and the overall application of GenAI in financial services.

Customer Education: Educate consumers about the potential risks, including conduct risks, associated with open finance and GenAI and offer guidance to identify and protect them against fraudulent activities.

Consumer Protection Framework: Implementation of a customer-based framework to address customer protection concerns. The customer outcomes-based approach to consumer protection should focus on customer outcomes such as suitability, choice, fairness and respect, voice and safety and security[5].

Robust Data Governance: Ensure that training data is diverse, inclusive, and unbiased. Conduct regular checks on datasets to detect and rectify any imbalances.

Explainable AI: Advocate for the importance and development of explainable GenAI models that allow consumers and institutions to understand the rationale behind decisions and recommendations. Moreover, the consideration of the benefits between the usage of supervise vs. unsupervised learning.

Continuous Monitoring: Implement robust monitoring systems to identify and address risks stemming from the application of GenAI to open finance.

Research and Development: Further research conducted to understand the deeper relationship between GenAI and open finance.

In closing, the nexus between open finance and GenAI has created massive transformative capabilities with a profound potential to reshape the financial landscape in South Africa, offering unprecedented opportunities for personalised services and efficient processes. However, the implementation of these innovative solutions carries risk that require diligent attention. By adopting a responsible and customer-based approach, financial institutions can harness the power of open finance and GenAI while protecting customers, driving financial inclusion, fostering financial innovation, and contributing to a safe and ethical financial ecosystem in South Africa.

[1] BIS (2020), “Enabling open finance through APIs", available

here.

[2] IMF (2023), “Generative Artificial Intelligence in Finance", available

here.

[3] aepd (2019), “A Guide to Privacy by Design", p5, available

here.

[4] Google (2022), “Responsibility: Our Principles", available

here.

[5] CGAP (2022), “Customer Outcomes-Based Approach to Consumer Protection: A Guide to Measuring Outcomes: Lessons from a South Africa pilot", available

here.

Disclaimer: As the IFWG we are enthusiastic to include diverse voices through our media content. The opinions of participants do not necessarily represent the views of the IFWG and their respective organisations.

Disclaimer: As the IFWG we are enthusiastic to include diverse voices through our media content. The opinions of participants do not necessarily represent the views of the IFWG and their respective organisations.